Restaurant Insurance

At Zein Insurance, we understand that your restaurant is more than a business—it’s your passion. Let us handle the risks, while you delight your guests with unforgettable culinary experiences. With specialized restaurant insurance, your establishment, staff, and patrons are comprehensively protected, allowing you to focus on what you do best.

Restaurant Insurance - What You Need to Know

Understanding Restaurant Insurance

Restaurant insurance is specialized coverage designed to protect restaurant owners from the unique risks associated with operating in the food and beverage industry. Whether you run a small café or a large fine dining establishment, having the right insurance policies in place is essential to safeguard your business against unforeseen events.

Key Coverage Areas

Commercial General Liability (CGL): This foundational coverage protects against claims of injury or third party property damage incurred at your restaurant. It’s crucial for day-to-day operations, covering everything from slip-and-fall accidents to damaged customer property.

Property Insurance: Protects the physical location of your restaurant and its contents from fire, theft, and natural disasters. This coverage is vital to quickly repair and replace essential equipment and fixtures without significant financial hardship.

Business Interruption Insurance: In the event of a disaster that forces your business to temporarily close, this insurance compensates you for lost income and helps cover ongoing expenses like rent and payroll.

Liquor Liability Insurance: If your restaurant serves alcohol, this coverage is indispensable. It protects against claims arising from incidents caused by intoxicated patrons, such as accidents or property damage.

Equipment Breakdown Insurance: Covers the repair or replacement of kitchen appliances and other critical equipment that break down due to mechanical or electrical issues.

Cyber Liability Insurance: As more restaurants use digital systems for reservations, orders, and payments, cyber liability coverage becomes essential. This policy protects against data breaches and other cyber threats that could compromise your customers’ personal information.

What Determines Your Insurance Needs?

- Location: High-risk areas for natural disasters may require additional coverage.

- Type of Service: Fast food, fine dining, and bars all face different risks.

- Size of Operation: The number of employees and seating capacity can affect your coverage needs.

- Alcohol Service: Serving alcohol increases liability risks significantly.

- Equipment Value: High-end kitchen setups might need more comprehensive equipment insurance.

Why It’s Essential

Without restaurant insurance, a single incident could be financially devastating. Comprehensive coverage not only helps you manage financial risks but also assures your customers and staff that they are in a secure and professionally managed environment.

Investing in robust restaurant insurance is not just a regulatory necessity—it’s a critical component of your business longevity and success.

Why Choose Zein Insurance?

Specialized Coverage for the Restaurant Industry

Your restaurant is unique, and so are the risks it faces. We offer tailored insurance policies designed specifically for the complexities of food service, ensuring that every aspect of your business is protected.

Proactive Risk Management

Beyond insurance, we partner with you to identify potential risks, offering strategies to prevent accidents before they happen. Your safety is our priority.

Efficient Claims Process

We know that time is money in the restaurant business. Our efficient claims handling means quick resolutions, minimizing disruptions so you can keep your doors open and your kitchen running.

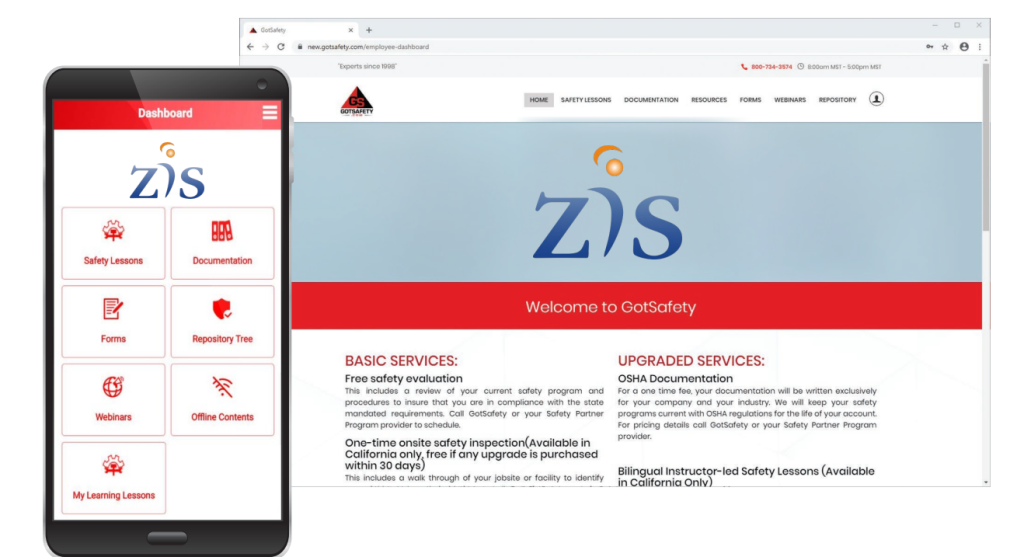

Complimentary Safety Partner Program For ZIS Clients

- Free Safety Evaluation

- One-time Onsite Safety Inspection*

(Free if any upgrade is purchased within 30 days) - Cal/OSHA Citation Defense*

- OSHA Citation Defense Consultation**

- Phone consultation during business hours

- Live safety webinars

Claim Scenarios

Equipment Breakdown (Refrigeration Failure)

Problem: The main refrigeration unit in your restaurant fails unexpectedly, spoiling thousands of dollars’ worth of perishable goods.

Outcome: Equipment Breakdown Insurance covers the cost of repairing or replacing the refrigerator, as well as the value of the spoiled food. Claims for such equipment failures and food spoilage often amount to $15,000 or more.

Liability (Slip and Fall)

Problem: A customer slips on a wet floor in the dining area, resulting in a severe injury.

Outcome: Your Commercial General Liability Insurance covers the medical costs for the injured party and any legal fees incurred if they decide to sue. Claims for slip and fall incidents often result in settlements or judgments averaging around $20,000.

Property Damage (Fire)

Problem: A kitchen fire spreads rapidly, damaging your restaurant’s cooking equipment and interior.

Outcome: Your Property Insurance responds to the claim, covering the costs of repairing the building and replacing the damaged kitchen equipment. Claims for kitchen fires can range upwards of $50,000 depending on the extent of the damage.

Key Coverage Options

Commercial General Liability (CGL)

Protect against claims of injury or third party property damage at your premises.

Property Insurance

Safeguard your establishment from fire, theft, and other damages.

Business Interruption Insurance

Cover losses in revenue when unexpected closures occur.

Liquor Liability Insurance

Essential if you serve alcohol, this insurance protects against alcohol-related incidents.

Equipment Breakdown Insurance

Keep your kitchen operational with coverage for repairs and replacements of crucial equipment.

Cyber Liability Insurance

Secure your digital operations and protect customer data from cyber threats.

Restaurant Insurance stage 2 no prefill

About Us